View Sale Announcement Detail

Archived news

Banks have proven that their disaster recovery plans are effective.

Banks have proven that their disaster recovery plans are effective.

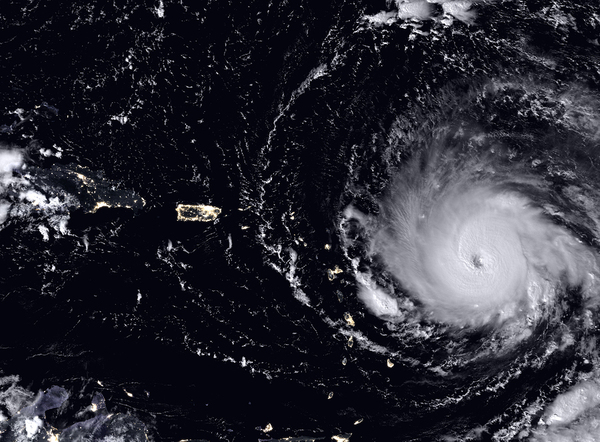

Banks are standing up to the devastating hurricanes that have slammed U.S. shores. A strong infrastructure and disaster recovery plan are the foundations of this fortitude. Several banks demonstrated their preparedness during and after Hurricane Harvey.

Take Texas-based First Community Bank, for instance, which was clearly ready to weather the highly destructive hurricane in August. Months prior to the first glimpse of the wild winds, the bank’s management held emergency readiness meetings every week and polished up their disaster recovery process. Their efforts paid off.

When word got out that Harvey was on its way to the Texas coast, the leaders of First Community Bank began mobilizing their plans. This involved deploying the operations team to its prepared backup site with its core processor. The team worked to ensure that business and retail customers would not experience interruptions to online and mobile services.

The bank also made certain that branches and ATMs were well-stocked with cash before, during and after the hurricane. During the hurricane itself, the bank's executives kept a close watch on the power at all locations and network status at all sites.

Houston, which was hit hard by Harvey, is the fourth-largest city in the U.S. and is a major market for a number of banks. It represents approximately 2 percent of the U.S. mortgage origination volume and bank deposits.

The fact that First Community Bank came out of Hurricane Harvey with little disruption demonstrates that its preparedness planning was effective.

The fact that First Community Bank came out of Hurricane Harvey with little disruption demonstrates that its preparedness planning was effective.

Houston-based Allegiance Bancshares Inc. was also well prepared for Hurricane Harvey. Despite the fact that just about all of its deposits are housed in the Houston metropolitan area, the bank fared well.

The bank did close a few branches that were direct targets, though many were reopened with no issue just a couple of days later. Even the bank's electronic banking went on as scheduled.

Big Banks Pass Stress Tests For First Time Since Financial Debacle of 2008

Hurricane Harvey posed one of the first real tests of how big banks would manage the challenges of a major natural disaster. Earlier this year, all 34 of the country's big banks passed the Federal Reserve’s yearly stress test of whether or not they are healthy enough to withstand a significant economic disaster.

Passing the Comprehensive Capital Analysis and Review stress test means that banks are considered to be financially strong enough to carry on with their functions and transactions amid a major crisis. The 34 banks currently hold $1.25 trillion in capital safety nets as of Q1 2017, which is twice that from 2009.

Since the banks managed to pass the stress test, they're better able to pay back their investors. That's good news for the banks, the investors that have a huge stake in them, and the economy as a whole.

The Bottom Line

Whatever banks have been doing over the past decade to strengthen their infrastructure seems to be working. Between passing grades from the annual stress test to literally weathering the storm from the recent deadly hurricane in Texas, banks seem to be in a highly robust state. With continued vigilance and a focus on optimizing loan portfolios, banks have an opportunity to hedge risk while profiting handsomely.

Sign up for our newsletter to stay current on trends and news that impact stakeholders in the financial industry.