View Sale Announcement Detail

Archived news

While many U.S. consumers have been benefiting significantly from sharply dropping oil prices, they may find they have even more money in their pockets after the Federal Housing Administration's recent decision to reduce its annual premiums.

Falling lending standards

As their situation improves, some lenders are gradually lowering their credit standards, according to American Banker. For example, Bank of the West, the third-largest California-based bank, has indicated that in 2015, it plans to transition a greater portion of its consumer finance portfolio to loans that are non-prime.

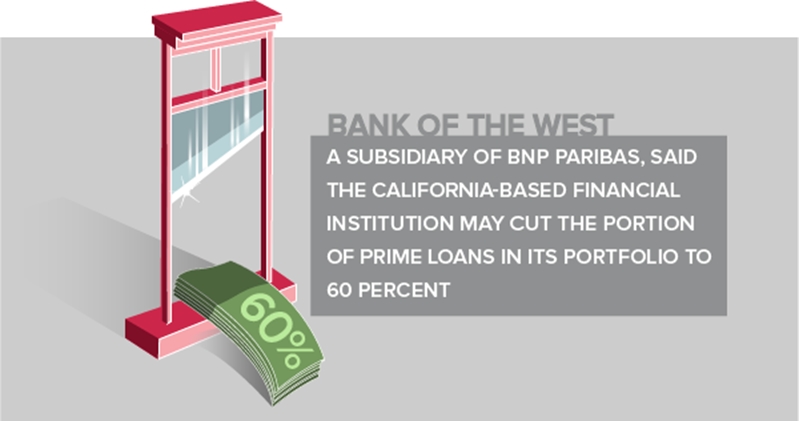

Paul Wible, national finance group head for Bank of the West, a subsidiary of BNP Paribas, said the California-based financial institution may cut the portion of prime loans in its portfolio to 60 percent from its current level of 75 percent, American Banker reported. The bank's consumer program represents 20 percent of the organization's outstanding loans, and lowering prime credits to 60 percent would be a "prudent way" to strengthen the program, he asserted.

Rizzi, a banking industry consultant and investor who teaches at DePaul University Chicago, asserted that while taking on greater risk in exchange for profit is perfectly reasonable, this approach can backfire if it continues for too long. He provided a handful of solutions, suggesting that banks work together to create common industry lending criteria.

Market risks

Many industry participants have warned about the potential consequences of falling credit standards, including banking expert J.V. Rizzi, who wrote in an American Banker column that lenders may be taking on too much risk to remain competitive in the current environment.

As their situation improves, some lenders are gradually lowering their credit standards.

Loan portfolio implications

Focusing on prudent lending practices may be wise, as rising discretionary income could easily combine with falling credit standards to boost loan origination and also place downward pressure on the quality of loan portfolios. While banks might be driven to grant more loans as business conditions improve and consumers demand more credit, this approach could trigger rising defaults further down the line.

Although defaults have declined over the last several years, a reverse in this general trend could have complex implications for financial institutions interested in loan sale transactions. To ensure they make deals that reflect their investment objectives, banks can benefit from speaking with Garnet Capital Advisors, a loan sale advisory firm with broad experience spanning many different debt types.